http://3approaches.wordpress.com/2014/03/23/appraising-the-right-way-part-1-requiem-for-a-dream/

Reposted with permission from the 3Approaches blog post from Woody Fincham, SRA and Rachel Massey, SRA, AI-RRS

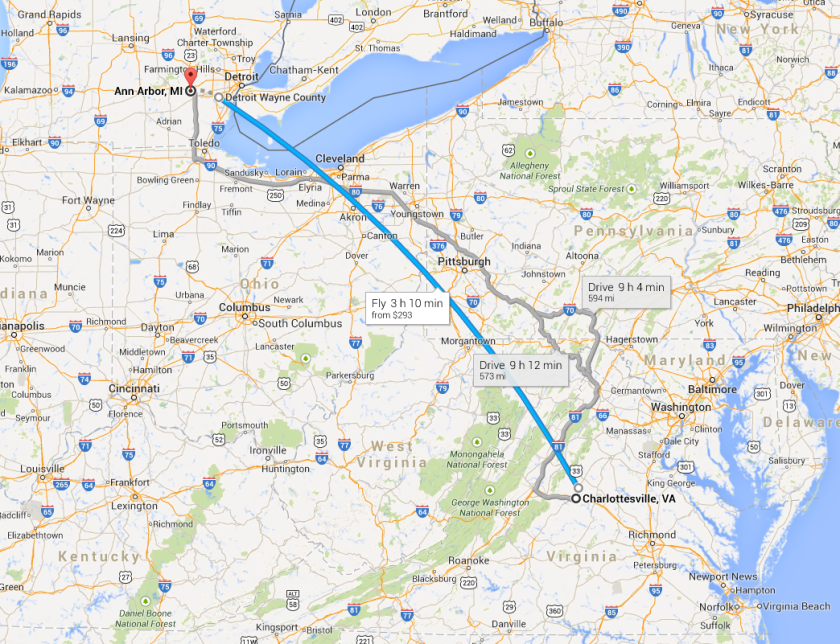

We are two appraisers separated by a three- hour flight or a nine-hour car ride. We have never met in person, but have come to know one another through social media. We are designated and recognized experts in residential valuation in our respective regions; both have had successful careers working in various positions within the profession; we are separated by enough distance that we experience completely different market stimuli. We subscribe to doing valuation work the right way. The way it should be done: defensible and well supported. Yet, we (and many others in the profession) are watching it being dismantled by the lenders, appraisal management companies (AMCs) and even from within the profession itself. This is not the way that it should be, yet we still stick to our guns and we dream about how it should be regardless of the present reality.

We share a dream:

Like any great dream, it is lofty, challenging and worthwhile. We dream that we can make a living as fee appraisers, doing our jobs the proper way. The dream is to take the time to analyze the problem to be solved; research the market thoroughly including market trends; interview the market participants; analyze the sales and extract market adjustments; and then report the opinion of value in a way that the client can understand the thought processes. Within this, there will be good support for conclusions and the appraisal will make complete sense to the reader. It will not leave gaping holes or questions. The opinion of value will be well supported by sales that are both inferior to the subject as well as those that are superior (and ideally equal). The appraisal will address the current market conditions and the active competition as well as the closed and pending sales.

Analysis is what we do, refined by the appraisal process, tempered by ethics and integrity all rounded out by participation in a profession that is carried out by like-mined and well-intentioned practitioners.

The dream continues:

Our clients will truly care about the analysis and it will be meaningful to them. They need something of substance, and not simply paper for a loan closing package, or simply a report for a divorce or bankruptcy proceeding. The client understands that the valuation is based on fact, but in the end is an educated and well-supported opinion. The client understands that each report is a unique and extensive research project that is custom designed. The client is comfortable with the opinion of value because they reached out to a well-qualified and experienced appraiser; one that is rewarded the report because they are respected professionals, not just another step in a loan closing process or the cheapest one they could find.

Prologue:

We realize this is getting into the lofty and idealist side of things, hence the title of the blog. What this series is going to focus on is some of the challenges appraisers face, and how we should handle them. There is constant pressure on appraisers to adhere to scope of work enhancements from clients. While we may mention customary and reasonable fees and the dynamic that the cost of business plays in the appraisal process in the course of this series, this is about what appraisers should be doing after they accept an assignment.

Rachel has years of experience reviewing appraisal reports working within the lending world as a staff reviewer and manager, and in the fee world through her private practice. Rachel has recently earned the new residential review designation with the Appraisal Institute. Woody has been doing private fee review work for years and also has to review reports for tax assessment appeal as part of his position within the assessor’s office in Albemarle County, VA. Between our combined experiences, we will focus on some issues that we see pop up repeatedly throughout various reports that have made their way across our respective desks over the years.